Ecommerce is evolving rapidly and shows no signs of stopping. By the end of 2022, global ecommerce sales are expected to reach approximately USD 5.7 trillion. Next year, this figure is expected to rise to around USD 6.3 trillion.

Heading into 2023, it is important to pay attention to how the ecommerce industry has performed over the past year and what PPC trends we should be following. It is crucial that we optimize our ad campaigns based on solid knowledge and real data.

In this article we will introduce you to five tactics that are highly underrated but will help you develop your online business and possibly get ahead of your competitors. The data for this article is taken from a feed marketing study conducted in 2022, on over 15 thousand online shops across 60+ countries.

1. Well-stocked product inventory is a chance to gain marketshare

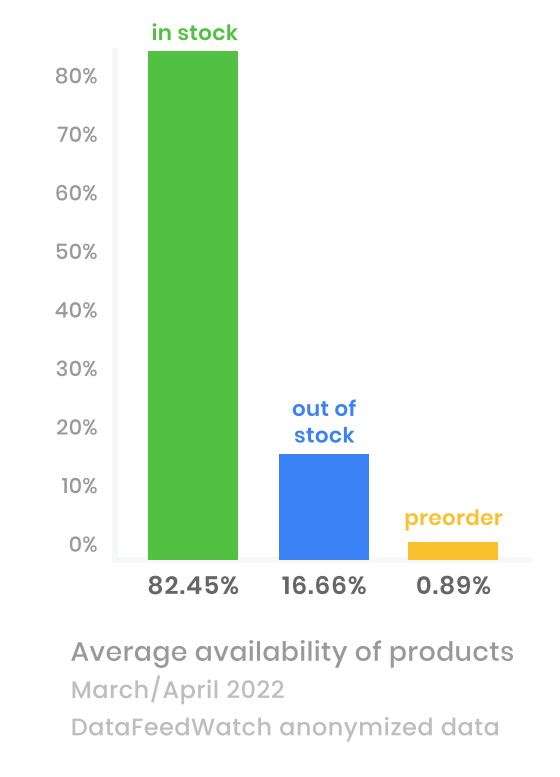

In the first half of 2022, on average 16.66% of products across all advertising catalogs were not available for sale.

Some ecommerce channels such as Google Shopping automatically stop showing ads for out-of-stock products because they don’t want to give customers a bad buying experience. Some other platforms don’t do anything about your unavailable products.

Customer experience is certainly an important aspect to consider when dealing with product availability in your ads. But, what’s more interesting is how the product availability levels across regions and ecommerce sectors could be used to identify growth opportunities.

A shortage of certain products on the market opens up new opportunities for online retailers, who are able to cover the demand for specific types of goods with their product offerings.

If you’ve found yourself in this position, consider multichannel expansion or more aggressive advertising to win extra market share and move ahead of competition.

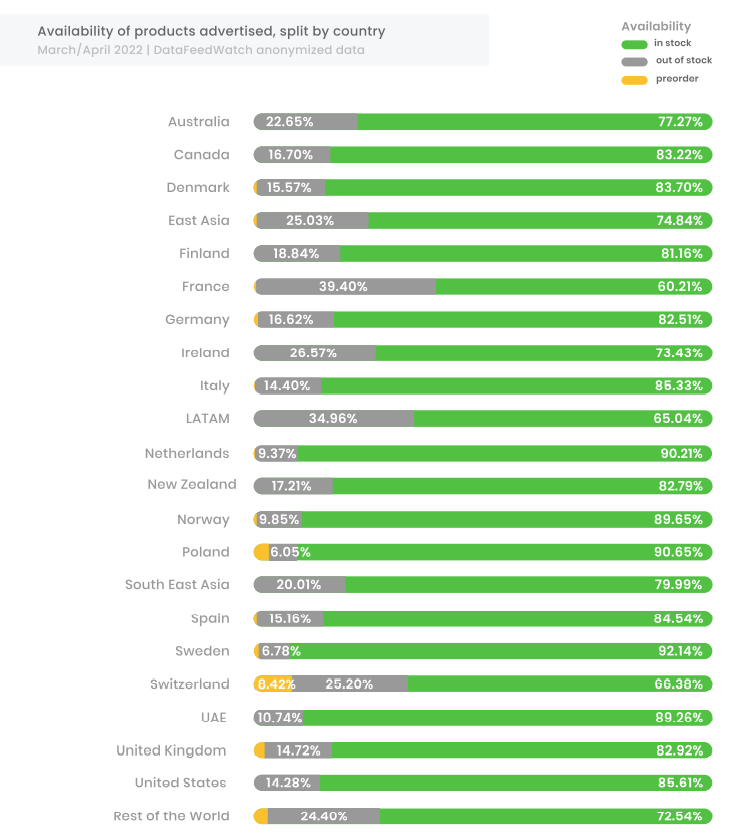

Product shortages by country

There are some markets that handle product shortages better than the others. The supply chain disruptions caused by Covid-19 pandemic, which occurred in mid-2021, affected many countries globally. According to Statista Supply Chain Index, some EU markets and the US had the biggest issue of this kind. However, they quickly overcame it and already in the first half of 2022, countries such as the US, the Netherlands, Sweden, Norway, and Poland gained a place among the markets with above-average inventories (85% – 92% of products were available in these markets).

The markets that are still struggling with product shortages as of the first half of 2022 are France or LATAM countries. There is 39.40% of out-of-stock inventory among French online retailers and 34.96% among merchants from LATAM theritory.

Product shortages by sector

When it comes to the specific sectors that have struggled with the supply chain disruptions throughout 2021 and 2022, we should mention the Vehicles & Parts sector. Reportedly 57.46% of products in this category were unavailable to purchase in Q1/Q2 2022. It shouldn’t come as a surprise, considering the automotive industry is one of the sectors affected the most Covid-led manufacturing disruptions.

The other sector that was strongly impacted by product shortages in 2021 is Apparel & Accessories. However, according to the Feed Marketing Report 2022, this sector seems to have handled the problem of supply chain disruptions, with an average of only 14.52% of inventory out of stock.

Availability of advertised products by eCommerce sector | Feed Marketing Report 2022

2. Affiliate channels are an unsaturated marketing space in ecommerce

Based on the research on which channel types online sellers most commonly use, we can conclude that affiliate channels appear as an untapped market opportunity in the ecommerce world. Only 11% of online advertisers choose these channels to promote their products.

The vast majority of advertisers use Search channels. To be precise 92% choose this type of platform, which shouldn’t surprise anybody. Search users are usually actively looking to make a purchase, making them the perfect target group.

Social channels are also quite a popular choice among online retailers as over 54% of them claim they use them in their strategies. Despite the fact that social media users usually have lower purchase intent, this type of platform is still considered to be a viable medium to advertise products. In addition to Search, Social channels remain an important revenue stream.

Popularity of Search, Social, and Affiliate channels among online retailers | Feed Marketing Report 2022

Coming back to affiliate channels, you can find many of them on the market, such as AWIN, Criteo, or CJ Affiliate. Not many ecommerce companies use them, and that seems to be a mistake.

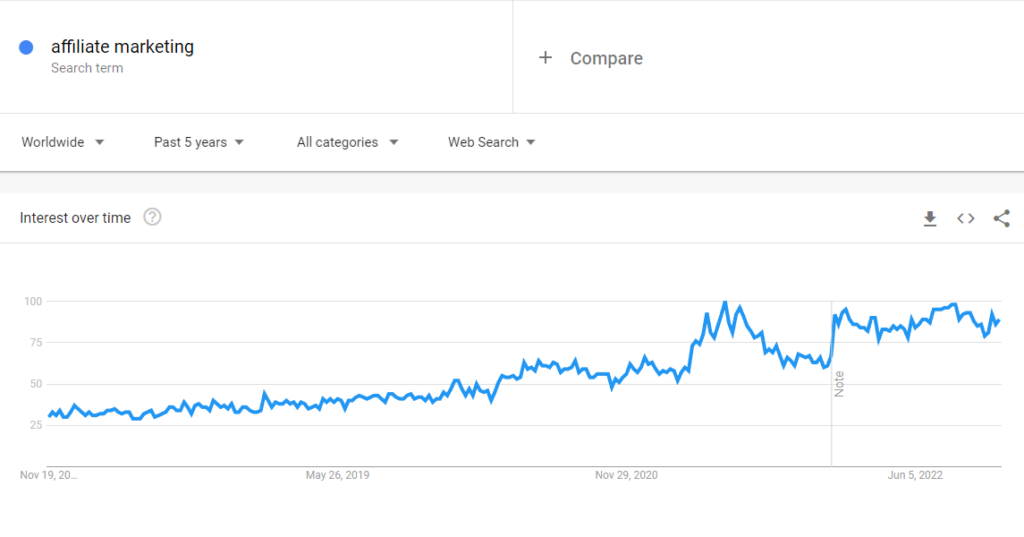

Based on the research, affiliate marketing drives 16% of ecommerce sales in Canada and the US. Moreover, in Google Trends we have noticed a constant growth in interest in affiliate marketing over the last 5 years.

Everything suggests that this small usage of affiliate channels by marketers does not mean that it won’t provide great value to your business. It may be that untapped market opportunity you’ve just discovered.

3. Expanding online presence cross-border without language diversification

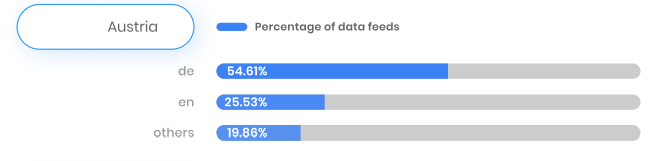

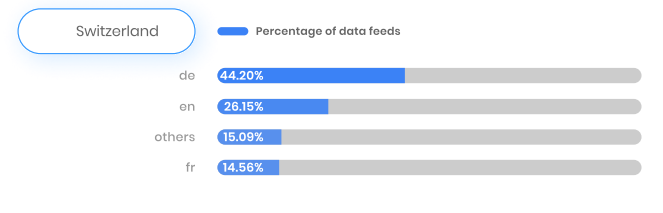

Most ecommerce retailers advertise products in the primary language of the market in which they operate. English is the second most commonly used language in product ads in the countries where the primary language is different.

English listings represent 13 to 26% of all product listings served in a given country.

The leading markets in terms of use of English product ads are European countries such as France, Belgium, Italy or the DACH region. Over 20% of product feeds submitted in these countries are submitted in English and not the primary language of the target country.

In Austria and Switzerland, over 25% of all product listings are in English. This indicates the big number of English speaking people living in this part of Europe.

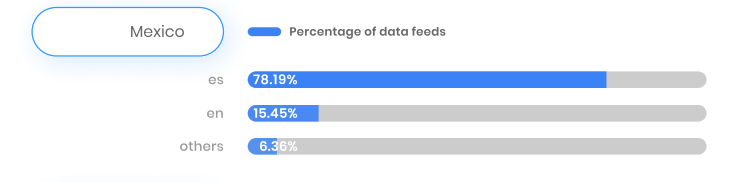

On the contrary, Mexico is the country where not many ecommerce stores have product ads in languages other than Spanish. Probably not without reason. Only 15.45% of all Mexican product feeds are submitted in English. In contrast, 78.19% of all listings in this country are in Spanish.

Usually ecommerce retailers start their advertising journey with a small number of channels. First, they choose to integrate search-based comparison engines like Google Shopping into their strategy. As the business grows, advertisers find interest in social, affiliate, or niche platforms.

What is interesting to notice is that 70% of online retailers who advertise on more than 1 channel only target only one country of sale. The other 30% promote their products

cross-border.

There is a hidden opportunity behind all of these numbers. If you want to expand your online advertising to other countries, running non-native ads could be a good way to go.

It’s usually not a perfect solution for a longer period of time, but can work as an ultra-fast entry to the market to create a presence there. The cons of running English ads in countries with other primary languages can be limited visibility and lower conversion rates compared to listings of the same items displayed in the local language.

4. Leveraging margin data to drive better results from PPC campaigns

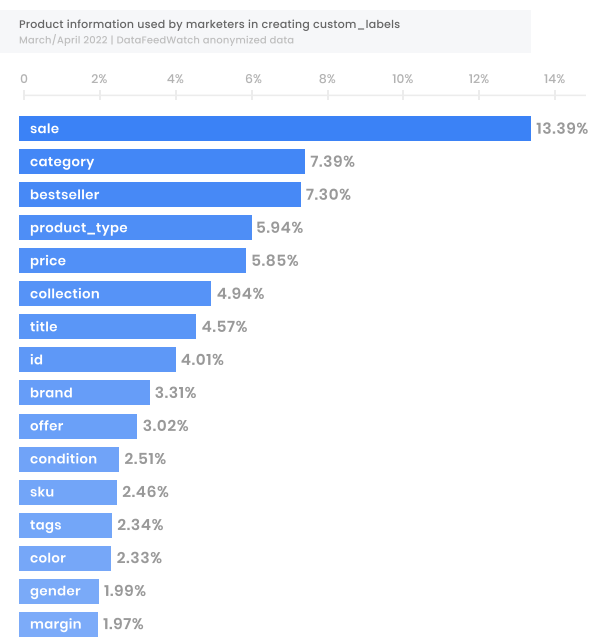

One of the much-underrated ways to improve the optimization of PPC campaigns can be including profit margin data in your feed. Thanks to this additional information you can then better segment and optimize your campaign.

2 out of 5 ecommerce advertisers create custom_labels in order to increase the ROI for their PPC campaigns. One of the attributes they can use when creating them is in fact product margin. However, only 1.97% of advertisers use this information to create custom_labels and then optimize their bidding and entire strategies.

This tactic is very uncommon, but at the same time can bring you great results. By including profit margin data in your feed and labeling products that have specific levels of profit margin, you can segment your campaign according to this attribute. In the next step, you can apply a totally different bidding strategy to low- and high-margin products.

We don’t understand why so few people take advantage of this tactic but this opens up an opportunity for you. Using margin data in your campaign helps optimize your advertising costs and save budget for other marketing activities.

Profit margin data can help you identify items in your feed that are not generating any profit for you. If you are looking for ways to optimize your ad spend and increase ROI, this knowledge can help you find products with low profitability potential in your inventory and then simply exclude them.

The types of products that might qualify for the exclusion are:

- low-margin products

- products where the CPA exceeds the profit margin

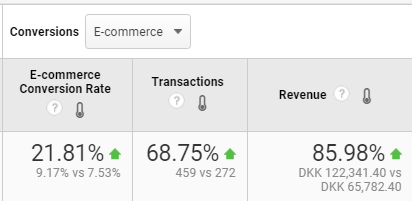

Real example

A nordic digital marketing agency created a profit-based custom label for their client. They identified high-margin products and labeled them. This way they were able to separate these products from the rest and apply a more aggressive bidding strategy on them.

The tactic turned out to be a great success and resulted in a significant improvement of customer shopping campaigns. Customer revenue grew by 85% and transactions grew by 68%.

5. Taking advantage of unified data requirements to grow your multichannel presence

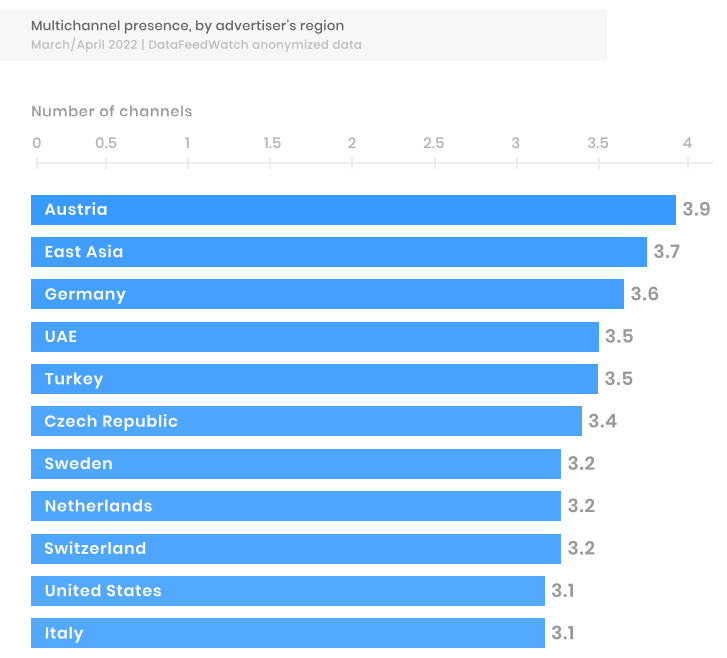

Multichannel strategy is widespread among ecommerce retailers. The global average for the number of platforms used by one advertiser is 3.2.

Regions like DACH, East Asia, or UAE boast of the above-average multichannel online presence. This is probably a sign of a more balanced market share of channels. Instead of a few large players controlling the market, there are more ecommerce platforms that have similar levels of popularity among online retailers.

Nowadays, it’s crucial to reach customers through multiple channels, otherwise the big competition may squeeze you out.

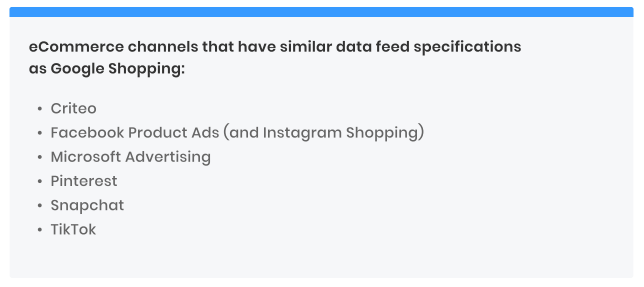

In fact, multichannel expansion can be easier than you think. Many ecommerce platforms have similar data feed specification requirements.

If you are already present with your products on Google Shopping, you can easily simplify integrating new marketing channels by reusing your Google Shopping feed on other platforms. You just need to adjust it a bit and you’re ready to expand to more channels.

The platforms that have very similar feed requirements to Google Shopping are Facebook Product Ads, Criteo, and more:

Summary

Those who rest on their laurels will not succeed in the long term. To continue achieving great results with ecommerce advertising, find and explore growth opportunities.

A good knowledge of your industry is a must to create a solid PPC strategy. Then, implementing some new tactics doesn’t take much effort and can significantly improve the performance of your product campaigns.

Jacques van der Wilt">

Jacques van der Wilt">